As someone who’s invested heavily in both crypto and precious metals, I’ve learned that during turbulent times, your portfolio needs more than just potential—it needs ballast. That’s where gold is reminding us of its timeless role, even as newer digital assets try to claim the same ground.

I’m still very much in the crypto space—with significant stakes in Bitcoin, Litecoin, and DigiByte—but I’ve been watching the market tilt toward gold with a mix of curiosity and validation. This isn’t a trend. It’s a reminder of why gold has endured for thousands of years.

Gold: The Original Store of Trust

Gold doesn’t need marketing. It doesn’t need updates or whitepapers. It’s been humanity’s store of value long before central banks even existed. And in a time where economic models are being questioned, fiat currencies are inflating, and global trust in institutions is wearing thin—gold is quietly doing what it always does: hold the line.

We’re seeing that now. Gold has surged to new all-time highs, pushing above $3,660/oz, not because of hype, but because of fear, fundamentals, and flight to safety.

Here’s what’s fueling that momentum:

- Central banks are loading up. Over the last few years, major economies—especially China and emerging markets—have been steadily increasing their gold reserves. That’s not symbolic. That’s strategic de-dollarization and long-term risk hedging.

- Inflation hasn’t disappeared. Even with rate hikes and central bank tightening, inflation remains sticky. And gold? It doesn’t pay a yield—but it doesn’t inflate either. It preserves purchasing power over decades, not just market cycles.

- Liquidity loves certainty. When capital gets scared, it wants to park somewhere it knows won’t blow up tomorrow. In that equation, gold is still unmatched. No counterparty risk, no tech bugs, no regulation shocks.

There’s also the emotional anchor gold provides. Investors may not admit it, but there’s a psychological comfort in holding something tangible, physical, and universally valued. When everything else gets abstract or volatile, gold feels real.

That’s why in my own portfolio, gold isn’t just a hedge—it’s the foundation. And right now, with geopolitical tension rising and debt levels unsustainable, that foundation is more valuable than ever.

Bitcoin: Digital Gold, With Growing Pains

Bitcoin is still the flagship of crypto. Its scarcity, decentralization, and brand recognition are unmatched. I’ve backed it for years and I’m not going anywhere. But let’s be honest—Bitcoin isn’t quite living up to the “safe haven” label… yet.

Lately, Bitcoin has been behaving more like a tech asset than a hard asset. When the market’s risk appetite fades, Bitcoin falls—hard. That’s not a knock on its future. That’s a reality check on its present maturity.

I still see Bitcoin as the monetary experiment of our time. But it’s not there yet in terms of being a true store of value. And in the current climate, that distinction matters.

Litecoin: The Practical Workhorse

Litecoin is still a go-to for speed, simplicity, and cost-effectiveness. It doesn’t have the Bitcoin spotlight, but it’s not trying to. It’s quietly maintained uptime, delivered fast transactions, and proven itself in the background.

It’s not trying to reinvent the wheel—it’s just making it smoother to roll. I see Litecoin as the cash equivalent to Bitcoin’s reserve asset potential. It’s my utility crypto.

DigiByte: Built for the Long Game

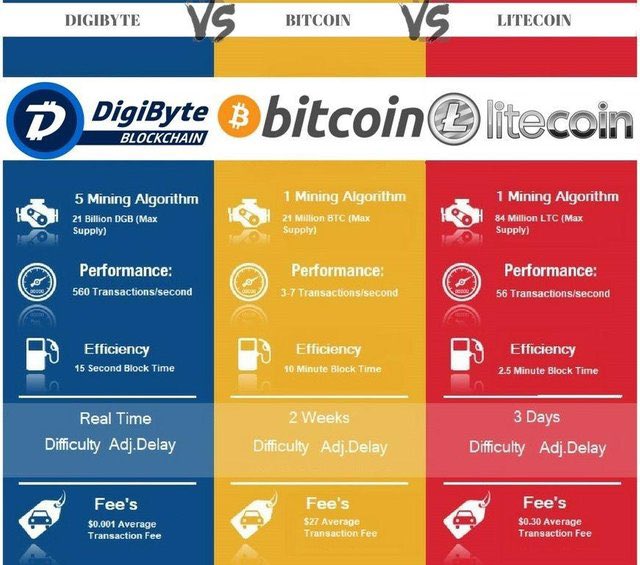

DigiByte is different. It doesn’t get the attention it deserves, but I’m watching it closely. Technically, it’s robust—fast, secure, highly decentralized. It’s not trying to win over institutional whales or meme its way to relevance. It’s just quietly delivering a serious infrastructure project.

With 5 mining algorithms, a 15-second block time, and over 11 years of clean operation, DigiByte isn’t just another coin—it’s a resilient blockchain that I believe is undervalued by most of the market.

I treat DigiByte as my deep-value infrastructure play in the crypto space and something I support and believe in.

The Bigger Picture: Different Assets, Different Roles

It’s a mistake to pit these assets against each other. To me, they serve distinct functions:

- Gold is the constant—centuries-tested wealth protection.

- Bitcoin is the long-term bet on digital monetary sovereignty.

- Litecoin is the everyday speed layer.

- DigiByte is the tech-forward infrastructure stack.

I don’t pick winners and losers—I build balance. I’m not trying to guess what will moon next. I’m trying to hold what will still matter 10 years from now.

Final Word: Respect the Old, Invest in the New

Gold’s rally isn’t a betrayal of crypto—it’s a reflection of reality. And that reality says: in a storm, you hold on to what’s proven.

But that doesn’t mean I’m letting go of Bitcoin, Litecoin, or DigiByte. I see value in innovation. I see what’s coming. But I also respect what’s already survived centuries of chaos.

This market isn’t about choosing between the past and the future. It’s about knowing when to lean on each.

And right now? I’m holding both hands open—one gripping gold, the other still holding on to digital.